One of the top buzzwords used by businesses these days is Analytics. All thanks to the changing world and technology because of which analytics has become important. Nowadays, with data being essential, it can even be said that data can make or break a company. Now Business Analytics is important for businesses.

Businesses have now widely embraced the use of analytics in work to streamline their operations and improve their processes. However, implementing business analytics into one’s business to make an informed decision isn’t that easy.

According to a survey conducted by Bloomberg Businessweek Research Service:

“Approximately 97 percent of the major respondents reported that their companies have adopted Business Analytics. The three most sought-after goals were the reduction of cost, increase in profits, and improved risk management. On the other side, a lot of organizations struggle to make sure that the data is accurate and consistent.”

Data is everywhere, however, sorting through it to find the ones that are useful to the business is an important skill that is a major need for the current marketplace.

Importance of Business Analytics

Below are a few reasons that will help give a brief idea of how it plays a vital role in the growth of any business.

Enhanced customer experience

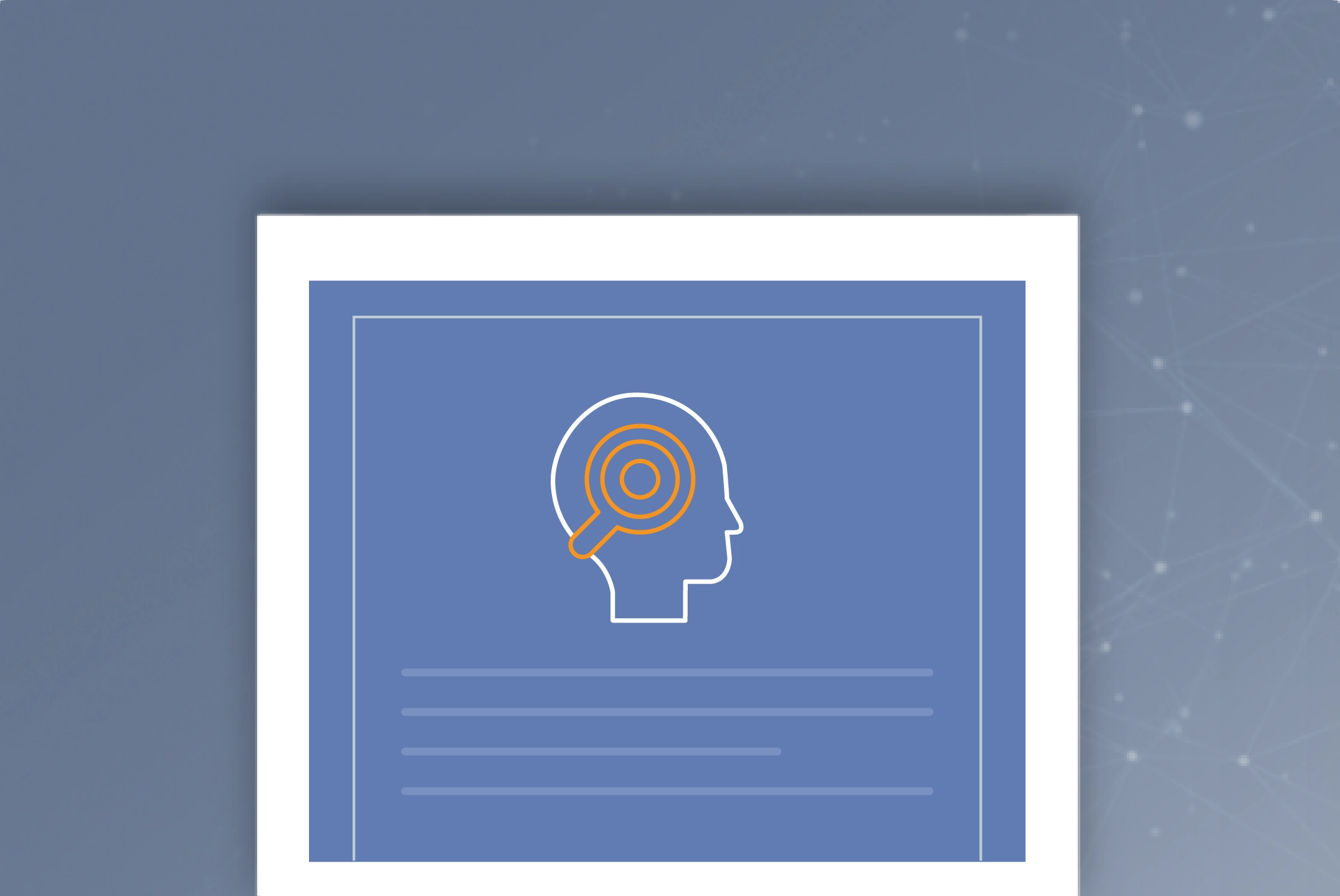

Businesses turn to analytics to make sure that they retain their customer base. For instance, an e-commerce company can analyze the customer interactions on their website such as the customer purchase habits, what is there in their cart and how frequent they purchase.

Basing on the data, the e-commerce company can make the necessary improvements to their web pages for improved performance. It can be something as simple as sending a notification of the products that the customer has added to the cart and hasn’t yet bought or remarketing other products that are similar to that of what the customer has already bought. Eventually, this helps in increased customer experience and loyalty.

Easy identifying frauds

A lot of finance companies are using business analytics to reduce fraud. The most common way of doing this is to identify the potential fraudulent purchase, based on the analysis of the customer’s earlier transactions. Usually, finance companies use predictive analytics to look into the customer profiles and check the risk level. This helps to gauge the risk that a particular customer possesses and use this analysis to prevent the loss, which eventually helps to build a stronger customer relationship.

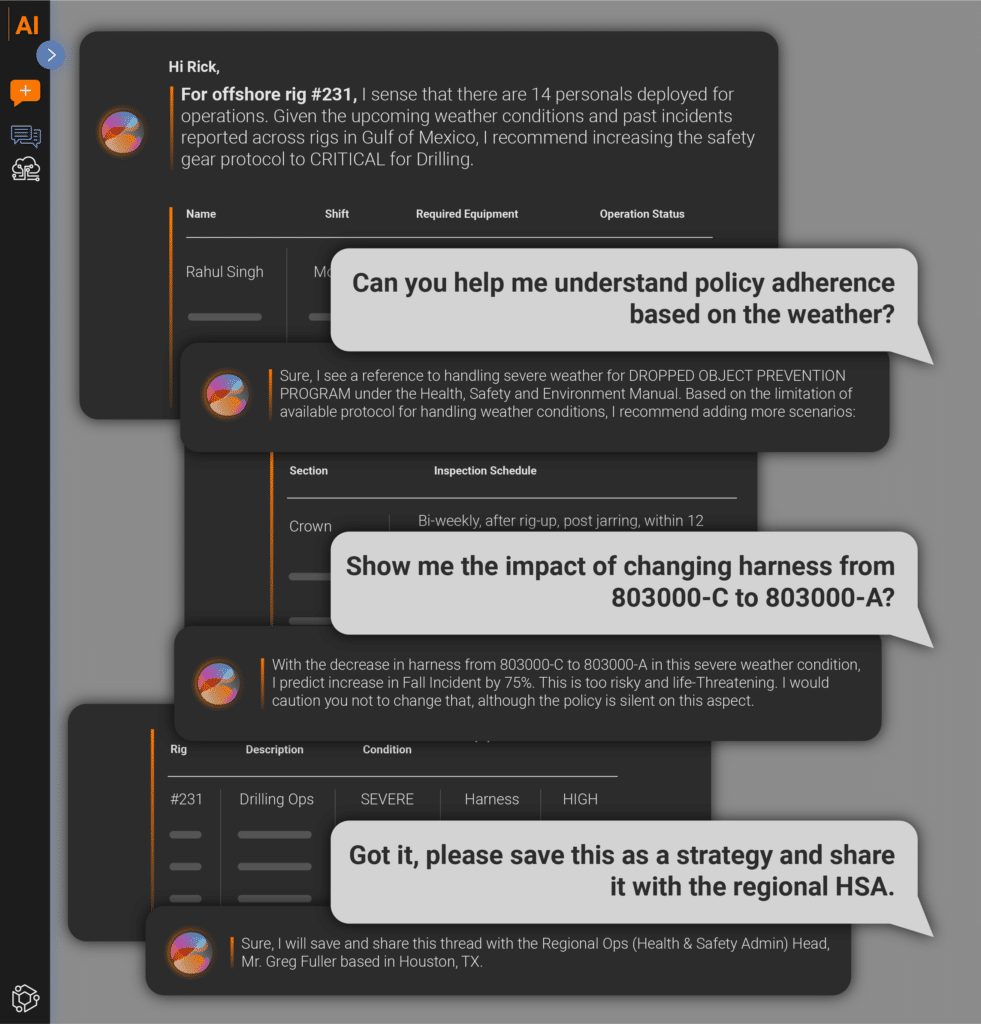

Informed decision making

Most businesses outsource a few of the processes to increase their efficiency. While selecting the vendor for such a business, they should be knowing what will help bring enhanced profits. However, with the help of analytics, the company can evaluate the performance of the supplier based on increased ratings, fulfilment of requirements, and quality. This data will help both the company and the vendor decide which idea works the best for the business.

Competitor analysis

Almost every business these days has a clear idea of their competitors. One of the best ways to stay in the competition is by understanding the competitors, their strategies, USPs, and what they are up to. Usually, companies like to do a SWOT analysis to get a preview of how their business is performing compared to that of the competitors.

There is no denying that business analytics is changing the dynamics and how the businesses used to operate. Its potential can’t be underestimated. With more and more companies relying on it for their decision-making process, it is time to consider incorporating it into your business too, if it hasn’t yet been done.